market in calgary

Team Penley McNaughton YYC Newsletter and Market Statistics

Click on the following link to view the full Team Penley McNaughton’s YYC Newsletter for May 2016

Calgary 2015 December Market Update

Housing market characterized by slow demand

Elevated supply levels placed downward pressure on prices in December:

Elevated supply levels placed downward pressure on prices in December:

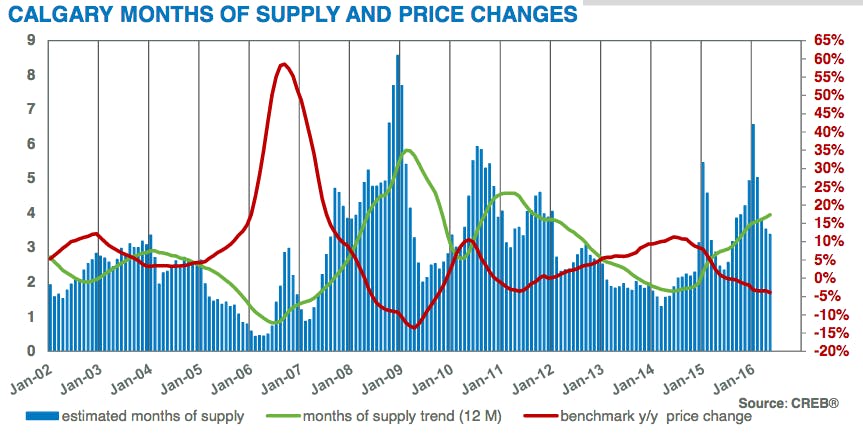

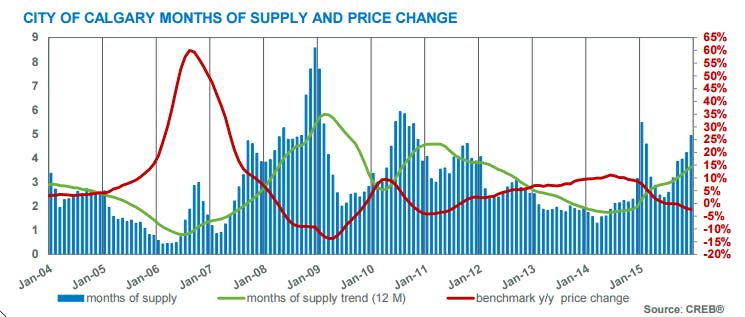

Calgary, Jan. 4, 2016 – With the focus shifting toward the holiday season, December sales activity slowed to 878 units in the city, 18 per cent below last year at this time and well below the five and 10-year averages.

As a result, the unadjusted benchmark price dipped to $448,800, a 0.42 per cent decline over the previous month and 2.33 year over year. CREB® chief economist Ann-Marie Lurie noted December followed a pattern established early on in 2015, which was characterized by slower housing demand.

“Economic uncertainty, followed by weak economic conditions and job losses, contributed to slowing housing demand throughout the year,” she said.

“That said, while aggregate prices trended down in 2015, it was not to the same extent as some had speculated. Supply levels were low moving into this cycle and thus provided some cushion to absorb the inventory gains.”

In December, monthly inventory levels declined, as expected, to 4,336 units. Yet they were still 28 per cent higher than the same time last year, and at the highest December level recorded since 2008. Inventory levels were notably up in both the apartment and attached sectors, which neared the highest December total on record.

“December showed that buyers in this market are continuing to be much more cautious as the impact of further oil price declines weighs on their confidence,” said CREB® president Corinne Lyall. “Some sellers, meanwhile, are concerned about what supply levels may look like next year and are not delaying their decisions.”

On an annual basis, sales activity declined by 24 per cent in the detached sector and 33 and 28 per cent in the apartment and attached segments, respectively. While months of supply in 2015 trended higher in all sectors, the apartment was the only one to average above four for the entire year.

Click here to view the full monthly stats package.

Alberta economy continuing its 'impressive boom'

The province is expected to be leading the country in 2014

RBC is predicting Alberta will lead the country in economic growth of 4.2 per cent in 2014.

In December, RBC forecast growth of 3.5 per cent this year for the province. The forecast for 2014 has remained the same.

“Even though the province recently announced a $2 billion budget deficit, Alberta is unquestionably in the midst of an impressive economic boom – particularly with capital investment fuelling manufacturing and wholesalers’ sales. Attractive employment opportunities are also bringing new migrants to the province, boosting population growth and in turn, consumer spending,” said Craig Wright, senior vice-president and chief economist at RBC. “As the economy continues to thrive across the majority of key industries, Alberta will remain at the top-end of Canada’s economic growth rankings this year.”

Economic growth in the province in 2011 was 5.1 per cent followed by 3.5 per cent last year.

Todd Hirsch, senior economist with ATB Financial, said Alberta’s economy is moderating somewhat.

“So I think we will see probably a slower year for growth than what we saw in 2011 or 2012,” said Hirsch. “A lot of that of course prompted by those softer energy prices and maybe a little bit of pullback by the provincial government. But I think we’re still going to see kind of a nice moderate healthy level of growth of around 2.5 to three per cent.

“Going forward beyond that it gets trickier and we don’t really do forecasts beyond 2013 but I would still see 2014 as a pretty good year … It’s not going to feel quite like the boom years of 2006, 2007 either. We’re just going to have nice healthy moderate growth.”

RBC said there are a few weak spots in Alberta’s economic outlook. Investment intentions in the oil and gas sector are essentially flat for 2013. RBC said Alberta’s energy developers’ plans are being weighed down by rapidly rising energy production in the U.S., pipeline bottlenecks and the ‘bitumen bubble’, all of which contributed to lower crude oil prices in Canada relative to global benchmarks late in 2012.

“Weaker than expected oil prices put a multibillion dollar hole in Alberta government’s revenues, and led to a 2013 provincial budget that detailed renewed public sector spending restraint,” said Wright. “Still, any pullback in capital spending will be short-lived as pipeline issues are addressed and crude oil price relationships normalize.”

“After boasting a relatively strong economic performance over the past several years, Canada’s economy hit a speed bump in late 2012,” said Wright. “That said, financial conditions continue to support growth. As confidence recovers, business spending should accelerate, albeit at a less rapid pace than we saw in the early days of expansion.”