SUMMER SALES STAY STRONG

Seller’s market conditions persist, pushing up prices

(click on the photo above to download the full report)

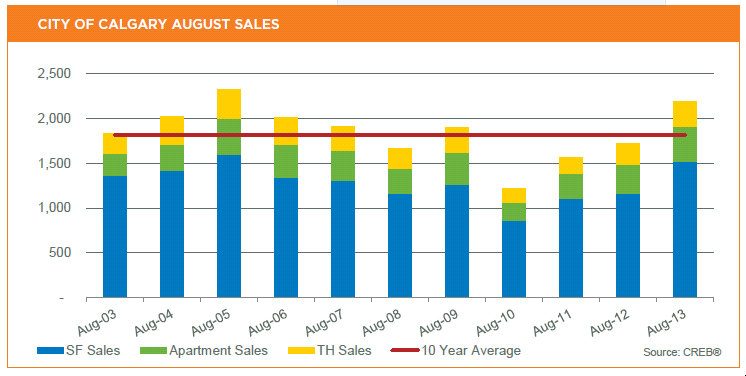

Residential sales within city limits totaled 2,196 units, an 27.5 per cent increase over 2012 and 8.7 per cent on a year-to-date basis.

The level of transactions was well above long-term trends for the month, mostly due to improved activity in the single-family sector. However, on a year-to-date basis, activity is only slightly higher than expectations.

“The sales have been limited by the need for more resale listings,” said CREB® President Becky Walters. “However, August did see more new listings than last year, giving buyers more choice.”

August new listings recorded a year-over-year improvement of 7.4 per cent. While seller’s market conditions persist and total inventory levels keep falling, improvement in new listings helped prevent further tightening in the market despite the sales growth.

Single-family sales totaled 1,517 units in August, a 30 per cent increase over the previous year. Despite strong sales in the past couple of months, year-to-date sales activity has grown by 5.4 per cent, slightly stronger than anticipated.

Click on the following link to download the full report of the Monthly Housing Statistics for August.