Home prices declined further in March as economic conditions weigh on Calgary’s housing market.

Calgary’s benchmark price totaled $442,800 in March, a 0.49 per cent decline over February and 3.51 per cent lower than levels recorded last year.

“With no improvement in the labour market, it’s no surprise that we continue to face downward pressure on housing sales activity and prices,” said CREB® chief economist Ann- Marie Lurie.

“Provincial unemployment rates are at the highest level recorded since the early ‘90s,” said Lurie, adding that Calgary’s unemployment rate in February rose to 8.4 per cent, which is higher than the provincial average of 7.9 per cent.

March home sales in Calgary totaled 1,588 units, 11 per cent below the same time last year and 28 per cent lower than long-term averages for the month.

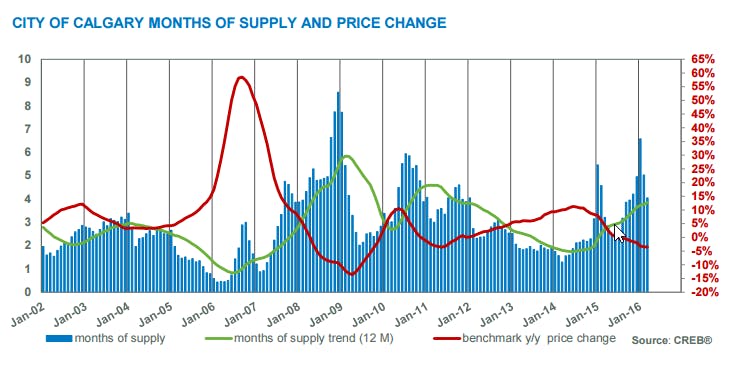

Calgary also saw housing supply gains in most price ranges.

Inventory levels rose by seven per cent to 6,084 units in March.

Overall, months of supply has averaged five months in the first quarter of 2016.

“As we move into spring, we are starting to see more foot traffic at open houses and showings from potential buyers,” said CREB® president Cliff Stevenson. “For now, this activity hasn’t translated into improved sales in most segments of the market.” The apartment sector has been the hardest hit by the recent downturn.

After the first quarter of the year, apartment sales totaled 554 units, a 17 per cent decline over the same period last year. Apartment benchmark prices have been trending down since late 2014.

In March, benchmark apartment prices totaled $281,300, seven per cent lower than levels recorded prior to the slide and 4.93 per cent lower than levels recorded last year.

The detached and attached sector has also felt the brunt of Calgary’s weakening economy. Detached and attached home prices have dropped by four per cent from the recent peak.

“Homebuyers continue to wait and see if there are going to be further declines in home prices before making an offer,” said Stevenson.

“Timing the bottom of the market is proving to be quite a challenge in the housing market we are faced with now.”

Beginning next month, the monthly statistics will be separated into two packages in order to provide a more comprehensive analysis of the housing market.

One package will contain Calgary housing statistics and district information to show the activity within areas throughout the city.

The other package will show housing activity in areas surrounding Calgary and provide a more regional perspective.

Click on the link: March_2016 to view the full report.

International Real Estate Specialists

Looking for a inner-city Calgary Condo?!?

TWO NEW LISTINGS!!!

Renfrew: Underground parking & fully renovated only $210,000!!!

If you’re an urban professional, someone looking for an incredible investment property, or you’re just looking for a great place to live, you’ve come to the right place. This bright, modern suite in Eagleview Estates features laminate and tile flooring, stainless steel appliances, maple cabinetry, and a neutral, modern colour scheme. In this well-managed building with several upgrades in the past few years, you’ll get heated underground parking, an elevator as well as surprisingly low condo fees. The unit has in-suite laundry, a good-sized, sunny, west-facing balcony, and a large master bedroom as well. The location and neighbourhood are amazing, close to all the brunch spots like Diner Deluxe on Edmonton Trail as well as an easy walk to Bridgeland and downtown. Park your car and walk to work! There are lots of parks nearby and great city views everywhere you go, this condo has been rented at $1450/month for the past year, has been immaculately maintained and is ready for immediate occupancy. CLICK HERE for Virtual Tour!!

AND!! Don’t miss this one in Chinatown: Walk Score 96/100!!!!:

Newly Updated trendy & modern open concept condo in Chinatown!

#610 205 RIVERFRONT AV SW

Trendy & modern open concept 1 bedroom condo in a secure building. Newly updated featuring; new quartz counter-tops, stainless steel appliances, new steam self cleaning oven w/ flat top stove, new stainless trendy pendent lighting over eating bar & A/C. Stylish master bedroom w/ hardwood flooring and a walk-in closet. Freshly painted in neutral colours. New high end Opera Shade Control blinds. Spacious bathroom w/ banjo extension & cabinet storage, tile tub surround to the ceiling & insuite laundry space. Insuite storage room. Enjoy a glass of wine & watch the sunset on the huge west facing balcony. 1 titled, heated underground parking stall. You will appreciate the security of on site concierge. Extremely clean & well managed building. Ideal location, close to the downtown commercial hub, steps to Eau Claire Market, cool shops & restaurants. Also enjoy nature w/ the Bow river walking trail and Prince’s Island Park right outside your door. Inner-city living at its best!! CLICK HERE for a virtual tour!!!

First-time buyers likely to feel main impact of new mortgage rule

Larger downpayments will be required by many Canadian homebuyers from next week as a new mortgage rule doubles the amount required by the CMHC for home purchases between $500,000 and $999,000 where the mortgage is more than 80 per cent of the home’s value. The hike, to 10 per cent, will have an effect but one group of buyers is set to feel the biggest pain.

Don Campbell, senior analyst at Real Estate Investment Network says that first-time buyers will be most affected, especially in the hottest markets. “It could certainly prevent them from getting into a market that is overheated,” he told the CBC.

Brian Yu of Central 1 Credit recently wrote that he expected Greater Vancouver prices “have more room to grow with little risk of a significant downturn.” Yu cites young buyers as the hardest hit by the new rule. Again these are probably going to be first-timers.

RBC’s Robert Hogue agrees that the higher downpayment will hit those buyers in the hottest markets, writing that it will “raise the bar to home ownership quite materially in Vancouver.”

- REP News

Global News:

Starting Monday, house hunters will face new rules requiring larger down payments on homes that are listed above $500,000. The changes are expected to have an impact on key real estate markets, but to what extent is up for debate.

“The increase will raise the bar to homeownership quite materially in Vancouver and Toronto,” housing experts at RBC Economics say. “Especially for first-time buyers.”

Announced in December by Finance Minister Bill Morneau, the minimum amount a buyer will have to put down on a home worth half a million dollars or more will increase from 5 per cent of the price to a blended, higher rate: 5 per cent down on the first $500,000, and 10 per cent down on any dollar value above that amount.

Let’s use the example of a $700,000 home. Under the (soon to be old) 5 per cent rule, a buyer would need $35,000 down to qualify for an insured mortgage loan.

On Feb. 15, the new minimum on that same home will jump to $45,000 or an additional $10,000.

The change is the federal government’s first move to cool the housing market since 2012, and is specifically aimed at levelling offsharp price jumps in two centres: Vancouver and Toronto (see chartbelow).

MORE: Latest coverage — The Great Canadian Housing Boom

By targeting higher-priced homes, the majority of the country’s real estate markets won’t see much of an impact, it’s believed.

“Rather than a blunt instrument, this is a targeted measure designed to deter a very small segment of buyers from stretching into the market with a very low equity position,” BMO economist Robert Kavcic says.

The current tightening manoeuvre is “a less aggressive move than those brought in back in 2012,” said Kavcic, who believes the change will have a minimal impact, even on its intended geographic targets.

There will nevertheless be some disruption. Here’s a look at how the new rules will affect homebuyers across the country.

More bad news for Alberta

Alberta cannot catch a break. Already pressured centres like Calgary and Edmonton will feel additional strain from the new rules, experts say.

Average prices in Calgary currently hover just under the half-million dollar mark, meaning “a good portion [of homes] in that already-stressed market will be within the targeted range,” Kavcic said.

Seven in ten new single-family homes sold in Calgary last year were priced above $500,000, according to the Canadian Association of Home Builders. Edmonton will feel the impact too, with more than two thirds of new homes sold in the city last year priced above half a million bucks.

“It’s unfortunate that Alberta home buyers are forced to pay the price for what are seen as problems in other parts of Canada.”

MORE: Alberta bears brunt of January job losses as oil rout cuts across economy

With household incomes already feeling the repercussions of relentless job cuts, bigger down payments are the last thing builders, agents and buyers and sellers want to see.

“It’s unfortunate that Alberta home buyers are forced to pay the price for what are seen as problems in other parts of Canada,” the province’s builder group said.

First-time buyers

Homeowners who are “moving up” to a bigger or more expensive property likely won’t feel the hit of the rule changes, experts say. That’s because they can leverage the proceeds from the sale of their existing home which will more than likely provide a more than sufficient down payment on the next property.

The added requirements will, however, price a larger percentage of first-time buyers out of the market. The changes will also motivate more to seek additional sources to borrow money from.

“First-time buyers at the margin who don’t quite meet the new down payment requirements could be forced to move down the price spectrum, defer purchases or find alternative financing for the bigger down payment – mom? Dad?” Kavcic said.

“Borrowers have increasingly been relying on less regulated non-banks and private lenders, or so-called shadow banking,” Derek Burleton, deputy chief economist at TD Bank said. “Further regulation may only push first-time homebuyer activity to these lenders.”

Shadow lenders don’t have the same stringent lending standards as traditional lenders like banks and credit unions, which could lead some borrowers to take on a riskier amount of debt, experts say.

MORE: The least affordable places to live in Canada are…

Hot markets

As for the country’s two most exuberant housing markets, the effects of the rule changes coming into force next week will either be fleeting and small or “material,” depending on which expert you ask.

In Vancouver, a first-time buyer of an average priced home will have to pony up an additional $22,000 – or 47 per cent more – to get over the hump of the new bare minimum of $69,000. In Toronto, the minimum to qualify for a mortgage on an average home in the city — now north of $625,000 — will rise by a fifth to $38,000, RBC economist Robert Hogue said.

Those calculations are based on the Canadian Real Estate Association’s latest data from December – prices in both cities have climbed since.

“We believe that the change announced [Dec. 11] will have a non-trivial impact on high-priced markets,” the RBC senior economist said.

TD’s Burleton disagrees. “Home price growth in Toronto and Vancouver has been the result of tight supply conditions, in the wake of strong demand. These rules don’t help alleviate supply-related pressures.”

MORE: House prices in Vancouver, Toronto are accelerating at ‘dramatic’ rate

The TD economist said buyers of pricier homes have been conditioned to have larger down payments because of past rounds of mortgage-tightening rules by Ottawa. Most purchasers in Toronto or Vancouver simply come ready to put down 20 per cent or more.

“Hot markets in Ontario and B.C. are being driven by purchasers with larger down payments, whether it be millennials getting help from their parents, move-up buyers or domestic [or] foreign buyers,” Burleton said.

The “bigger picture fundamentals” driving home price gains in Toronto and Vancouver — restricted supply of detached homes, demographic demand, low mortgage rates and inflows of foreign wealth — “remain firmly in place,” BMO’s Kavcic said.

Copperfield family home, cul-de-sac, bonus rm, finished basement

239 COPPERFIELD GR SE – $449,000

Ideally located on a quiet cul-de-sac between two playgrounds, steps from a green space! This 3 bedroom home with a double attached garage is in fabulous condition. The kitchen area is perfect for entertaining and you will appreciate the maple cabintry, pantry and stainless steel appliances.The family room is adjacent to the kitchen -enjoy the cozy fireplace. Your sought after spacious SW facing yard with a deck is a wonderful spot to relax and enjoy in the summer months. The upper level includes a master with a fabulous 5pc ensuite, two additional bedrooms and main bath.Your family will enjoy the spacious bonus room.The finished basement features a recreation room and 2 piece bath. Large windows allowing plenty of sunshine.The recreation room features a Murphy bed if you should be needing an extra bedroom for guests. Copperfield is an excellent family community- close to the hospital -shopping and easy routes to the mountains and downtown. This home is move in ready! CLICK HERE for the virtual tour!!

Wow! BC home sales hit new record!

Home sales in British Columbia hit a new record in December. The BC Real Estate Association reports that there were 6,590 homes were sold in the month through its MLS system, up almost 30 per cent year-over-year while total dollar volume hit a record $4.62 billion, an increase of 55.4 per cent from the previous December.

“The 2015 housing market finished in dramatic fashion, with record demand for the month of December,” said Cameron Muir, BCREA Chief Economist. “BC home sales breeched the 100,000 unit threshold in 2015, and it was only the third time on record that this high watermark was achieved.”

The average price in the province climbed above $700,000 for the first time in December, up 19.7 per cent from a year earlier.

Total dollar volume for 2015 was up almost 37 per cent from 2014 at $65.3 billion.

http://www.repmag.ca/market-update/bc-home-sales-hit-new-record-201856.aspx

Just move in Auburn bay: double garage, finished basement and more

213 AUTUMN GR SE – $419,900

This outstanding property in the popular community of Auburn Bay might be the perfect place for you to call home! Seller has completely finished the basement as well as a double detached garage! Lower level includes a recreation room complete with wet bar (an ideal space to entertain) as well as a flex room currently being utilized as a home gym. The bright kitchen with Bay window allows plenty of sunshine and includes a pantry and convenient island. Both bedrooms on the upper level have their own ensuites and the master bedroom is quiet spacious. Neutral color scheme throughout with lots of natural light.The quiet street with great neighbors offer plenty of room for cars for visitors. Enjoy the sunny backyard with perennial flowers and an over sized double garage.This lake community provides a special life-style,lake access in the summer, skating in the winter,and walking pathways. Click here for a virtual tour!

This outstanding property in the popular community of Auburn Bay might be the perfect place for you to call home! Seller has completely finished the basement as well as a double detached garage! Lower level includes a recreation room complete with wet bar (an ideal space to entertain) as well as a flex room currently being utilized as a home gym. The bright kitchen with Bay window allows plenty of sunshine and includes a pantry and convenient island. Both bedrooms on the upper level have their own ensuites and the master bedroom is quiet spacious. Neutral color scheme throughout with lots of natural light.The quiet street with great neighbors offer plenty of room for cars for visitors. Enjoy the sunny backyard with perennial flowers and an over sized double garage.This lake community provides a special life-style,lake access in the summer, skating in the winter,and walking pathways. Click here for a virtual tour!

2015 Housing Market Outlook Report

This year’s report indicates Canada’s average residential sale price is projected to increase two to three per cent in 2015.

Most regions posted modest gains in average residential sale price, despite increased inventory in many of Canada’s housing markets. Residential property markets in Toronto, Vancouver and their surrounding areas, as well as Calgary and Edmonton continued to see prices and sales rise. The greater areas of Vancouver and Toronto saw inventory of singlefamily houses remain at a record low, while demand continued to climb. Prices in these markets are expected to continue to increase in 2015, by approximately three per cent in the Greater Vancouver Area and four per cent in the Greater Toronto Area. Healthy gains are also anticipated in Kelowna (7%), Victoria (4%), Windsor (5%) and Moncton (6%).

Outside of B.C., Alberta and some areas of Southern Ontario, higher inventory levels was a significant trend characterizing much of the Canadian housing market in 2014. In some markets, the long, cold winter and late start to the spring season created a build-up of listings on the market, which continued to have an impact throughout the year, but also resulted in higher than usual activity in the fall as buyers came back to the market. In many cities in Canada, notably St. John’s, Quebec City, Ottawa and Halifax, increased construction over the past several years contributed to an increase of inventory. However, with construction of new buildings winding down, inventory levels are expected to balance within the next couple of years without having a notable impact on property prices.

With an increased supply of inventory on the market going into the new year, the average sale price is expected to remain stable or rise modestly in most cities in 2015. Montreal (1%), Quebec City (1.5%), Ottawa (1.6%) and Sudbury (1.6%) are expecting a modest rise in average residential sale price, while little change in prices is expected in Winnipeg, Saskatoon and St. John’s.

Condominiums continued to grow their share of the market in many regions. In Toronto and Vancouver, higher prices and limited inventory for single-family homes mean that condominiums are becoming a practical choice for many young buyers looking to enter the market. In Montreal, Kingston, Burlington, and Victoria, condos are increasingly attracting Baby Boomers looking for affordability and amenities within walking distance.

Many first-time buyers continued to feel the impact of the Canada Mortgage and Housing Corporation’s tightened lending criteria, which were revised in 2012. The new mortgage lending regulations have delayed the entry of first-time buyers into the market in many regions, thus slowing down the rest of the market. Regina and Saskatoon were exceptions; well-paying jobs and a good availability of affordable options meant that young buyers were typically able to qualify for a mortgage for their choice of home in these markets. The new mortgage rules will likely have less of an effect in the coming year as buyers adapt to the new regulations and make the necessary changes to meet the criteria.

The historically low interest rates of the past several years have helped sustain demand, and have mitigated the impact of the tightened lending criteria. The Bank of Canada has hinted at a rate increase in late 2015, and some experts have speculated that the increase could come as early as May. An interest rate hike could potentially result in a spike in buying activity, as buyers rush to secure their mortgage before the increase comes into effect. Overall, a rate increase is not anticipated to have a dramatic effect on the real estate market, as it would likely be minor and rates would continue to be low.

For more details and information, check out the Market Outlook for 2015 for all of Canada.

Calgary resale housing market continues to sizzle in October

Second highest MLS sales ever for the month

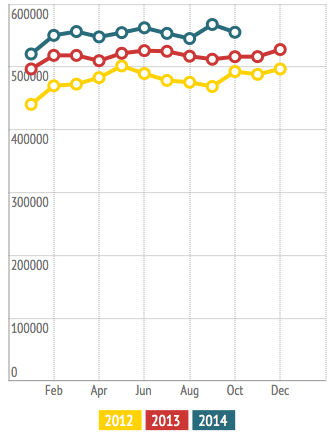

Average Price of Calgary single-family homes:

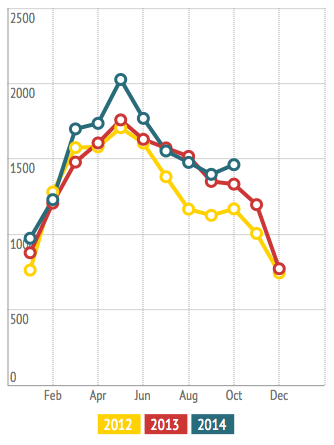

Sales in Calgary for single-family homes:

Average price of Calgary condo apartments:

Sales in Calgary for condo apartments:

Calgary’s booming resale housing market showed no signs of slowing down in October as MLS sales reached their second highest level ever for the month while prices continued to gain year-over-year.

According to the Calgary Real Estate Board, total MLS sales in the city during the month increased by 10.22 per cent from last year to 2,147. The median price was up by 5.33 per cent to $430,550 while the average sale price rose by 6.50 per cent to $488,474.

New listings of 2,919 were up 15.79 per cent from October 2013 and active listings at the end of the month increased by 15.28 per cent to 4,428.

“October showed little sign of the housing market slowing down as sales momentum continued this month. Positive sales growth throughout the housing sector was demonstrated largely in part by the record number of luxury home sales as well as a steady resale market,” said Kaitlyn Gottlieb, a realtor with Century 21 Bamber Realty Ltd. “Net migration and population growth, coupled with Calgary’s vast employment opportunity together with comparatively high wages, remain the driving factors behind the price growth Calgarians continue to see.

“Although still below historical norms, improvements in Calgary’s inventory levels and the easing of market tightness has added to listing growth and furthered stability, alongside sales this quarter. As we approach the end of fall, we continue to see a firm confidence in both homebuyers and investors adding to the anticipation that sales will remain at a positive level moving into the winter months.”

Mike Fotiou, associate broker with First Place Realty, said October sales were just behind the all-time record of 2,204 set in 2005 for the month.

Average sale prices in October neared the all-time records of $492,136 for the city which was set in June this year and $567,653 in the single-family market which was established in September.

In October, the single-family home market saw sales of 1,462, up 9.68 per cent year-over-year. The median price rose by 8.41 per cent to $490,000 while the average sale price was up by 7.53 per cent to $555,251.

The condo apartment category had 385 transactions, up 14.24 per cent. The median price rose by 4.04 per cent to $283,000 and the average sale price increased by 4.18 per cent to $322,358.

In the condo townhouse segment, sales of 300 were up by 7.91 per cent from last year. The median price of $333,766 and the average sale price of $376,227 were up 4.71 per cent and 3.70 per cent respectively.

And in the towns outside Calgary market, MLS sales climbed by 27.23 per cent to 486 transactions as the median price was up 7.57 per cent to $387,250 and the average sale price rose by 8.32 per cent to $412,026.

“Even as we enter the traditionally slower season of Calgary real estate, we continue to witness a strong demand,” said Don Campbell, senior analyst with the Real Estate Investment Network. “This demand is being tempered, a bit, by concern surrounding the oil price and thus keeping our market price increase away from the percentages we witnessed in 2006-2007. Away from the statistics, on the street analysis is beginning to show a slowing down in the number of showings, especially in the upper half of the market. This slowdown will reflect into sales statistics over the coming three months and if sales in the higher end of the market are slower, that will keep a cap on the ever-quoted average sale price.”

“Migration to the city continues to be strong bringing low vacancy rates and increasing rents. This means that first-time home buyers continue to prop up the lower end of the market while keeping demand strong.”

CREB also keeps track of what it calls a benchmark price on typical properties sold in the market. The benchmark prices for each housing category as well as percentage annual change are: single-family, $513,500, 9.7 per cent; townhouse, $337,800, 9.7 per cent; apartment, $299,800, 8.6 per cent; composite, $460,700, 9.5 per cent; and surrounding towns, $379,600, 9.43 per cent.

Ann-Marie Lurie, chief economist with CREB, said overall demand continues in the local real estate market.

“We’ve had the strong employment growth. The migration that we’ve seen over the past few years. And now there’s been listings. So there’s been some selection in the market and that’s really encouraged some of that demand,” said Lurie. “We still are in a period of favourable lending rates. All of that is encouraging the sales activity that we’ve seen.

“It hasn’t shown any sign of slowing because we’ve had the listings. What’s really shifted is that the market is more balanced now than it was even three to six months ago.”

CREB’s monthly report said there was only 18 per cent of new single-family listings priced below $400,000 and only 387 remained in inventory by the end of the month.

“All citywide resale segments have recorded a moderate easing of supply constraints, which should help stabilize prices as we approach the end of the calendar year,” said Lurie. “Nonetheless, consumers should be aware that market conditions can vary significantly depending on the location and property type.”

By Mario Toneguzzi, Calgary Herald

Calgary luxury home sales on record pace

Every month this year has set a new peak for MLS transactions

The appetite for luxury homes in Calgary continues to be very strong as another MLS sales record was established in August.

The appetite for luxury homes in Calgary continues to be very strong as another MLS sales record was established in August.

According to the Calgary Real Estate Board, there were 69 properties that sold for $1-million or more during the month, eclipsing the previous monthly high of 64 set last year.

Each month this year has established a record for luxury home sales.

Year-to-date, there have been 611 luxury home sales until the end of August compared with 522 for the same period last year. The all-time peak for annual sales at the $1-million plus level was in 2013 with 726 MLS transactions.

“Bolstered by the city’s thriving economy, the strength of its oil and gas sectors, low unemployment rates, high average net incomes and strong net migration, the market for high-end homes continued its upward trajectory with single-family home sales up 19 per cent and attached home sales up 21 per cent year-over-year,” said Sotheby’s International Realty Canada’s Top-Tier Real Estate Report for the first half of the year, which was released on Thursday.

“Due to limited inventory in Calgary’s condo market, sales decreased 25 per cent compared to the same time last year. With a number of new high-end condo projects recently announced in Calgary’s downtown core, it is expected that the volume of luxury condo sales above $1 million will increase in the second half of 2014.”

Ross McCredie, president and chief executive of Sotheby’s International Realty Canada, said the Calgary housing market is still relatively inexpensive for many people who have moved to the city from other parts of Canada.

“There’s a ton of different factors (to the luxury home boom) but overall there’s a ton of confidence,” he said.

“Low interest rates, a lot of confidence specifically in Calgary where you have a lot of investment, very, very low unemployment and you have huge demand for jobs . . . Overall we don’t see anything that’s going to change in the horizon right now for us.”

The Sotheby’s report said low inventory in the beginning of the year drove bidding wars and price increases in a market that favoured sellers.

“Over the summer months, new inventory over $1 million emerged to meet strong consumer demand, particularly in the condominium market, a trend which is expected to continue into the fall,” it said. “At the same time, Calgary’s robust economy is expected to sustain demand for luxury real estate, and notable growth is expected in the $4 million single-family home market throughout the fall and into 2015 as this category has already outpaced 2013 sales numbers.”

By Mario Toneguzzi, Calgary Herald

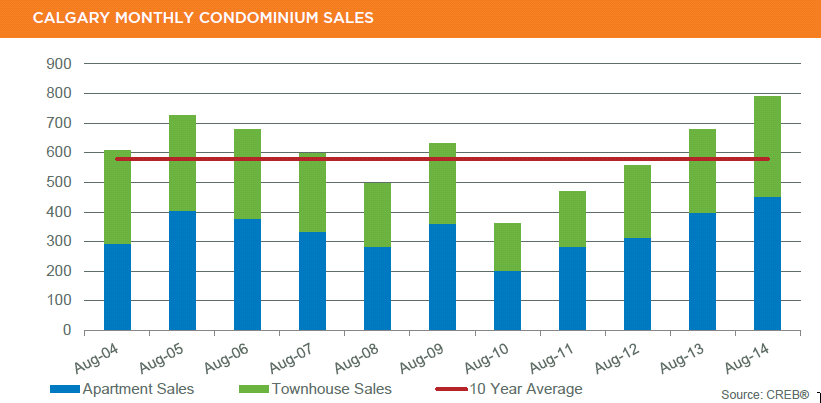

CALGARY REGIONAL HOUSING MARKET STATISTICS – August 2014

Condominium sales set a new record for August activity

Sales activity improves for condominium product, while declining in the single-family sector

Strong gains in Calgary’s condominium apartment and townhouse sectors sparked a 3.4 per cent year-over-year growth in residential resale housing sales activity for August. A total of 2,267 units exchanged hands in the city during the month, compared to 2,192 during the same period in 2013.

The condominium apartment and townhouse sectors saw the biggest gains, increasing by nearly 14 and 20 per cent, respectively, for total monthly sales of 790 units. “The record pace of August sales in the condominium sector is related to the relative affordability of this product combined with a tight rental market and low lending rates,” said CREB® chief economist Ann-Marie Lurie, noting most of the activity continues to take place in lower price ranges.

“More than 76 per cent of condominium new listings are priced below $400,000 and represent more than 68 per cent of the total inventory within city limits.” So far this year, condominium apartment and townhouse sales have totaled a respective 3,388 and 2,685 units. This represents a combined increase of nearly 20 per cent.

“Over the past three months apartment-style new listings have increased by more than 40 per cent year over year, pushing up overall inventory levels and moving this market toward balanced territory despite the strong sales growth,” said Lurie. Meanwhile, year-over-year single-family sales declined by 2.4 per cent in August to 1,477 units, partly due to limited availability in lower price ranges. Despite the pullback, activity in the sector remains stronger than long-term averages.

“The decline in single-family sales is mostly due to the shrinking supply in the under-$400,000 sector,” said CREB® president Bill Kirk. “Overall, sales activity has improved compared to last year for product priced over $400,000.”

The good news for buyers is added choice. New listings in August improved by 13.6 per cent compared to last year, causing inventories to rise by nearly 18 per cent. Increased inventory levels also moved the single-family market toward more balanced conditions, helping minimize further monthly price gains.

The single-family unadjusted benchmark price totaled $512,300 in August, similar to July, but still 10.24 per cent above $464,700 posted a year ago. “Following a prolonged period of Calgary being a sellers’ market, a move toward more balanced conditions is welcome news,” said Kirk.

“This will help support a more stable city housing market in terms of price gains.” The average, median and benchmark prices for condominium apartments in August were a respective $332,006, $287,500, and $298,200. “While both average and median prices in this sector have recorded further monthly gains, the benchmark indicates prices are similar to levels recorded in the previous month,” said Lurie.

“The composition of apartment sales shifted toward the higher-end segment this month compared to last month, resulting in higher monthly gains. The benchmark price reflects price changes for similar properties, less subject to the variability in composition.”

Condominium townhouses remain the tightest of the three sectors in Calgary, resulting in further monthly price gains and reaching an August benchmark price of $328,300. While prices are shy of previous highs, they increased by 0.4 per cent over the previous month and nearly 10 per cent above levels recorded in August 2013.

Click Here to view the full .pdf of the CALGARY REGIONAL HOUSING MARKET STATISTICS – August 2014