But decline almost 8% in 2015

Housing starts in the region are forecast to rise by 24 per cent in 2014 from last year but then dip by 7.7 per cent in 2015, according to a new report released Wednesday by Canada Mortgage and Housing Corp.

The agency’s housing outlook says starts in the Calgary census metropolitan area will increase from 12,584 in 2013 to 15,600 this year but then fall to 14,400 next year.

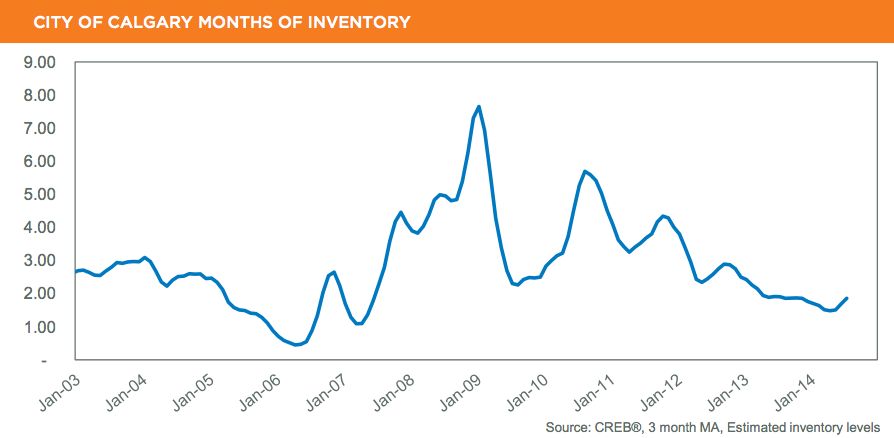

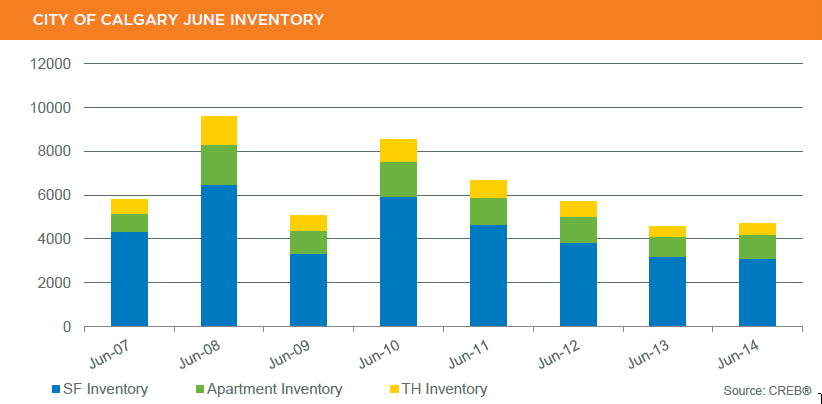

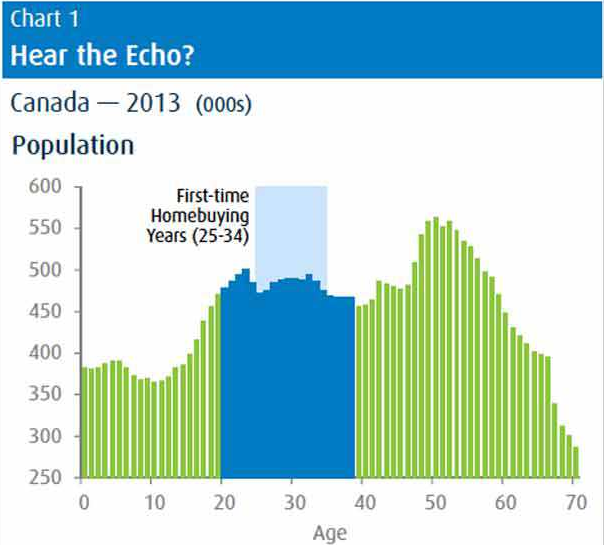

“The rise in total housing starts this year is due to a combination of increased demand and a decline in supply,” said Richard Cho, senior market analyst in Calgary for the CMHC. “Employment growth in Calgary continues to post impressive gains with the majority in full-time positions. Low mortgage rates have also helped people purchase a home and migration has been elevated in the last couple of years. This has supported the demand for housing. Selection in the resale market has been low which has led to some prospective buyers to look to the new home market. Not only are active listings low but new home inventories are down, which will also contribute to the rise in construction this year.

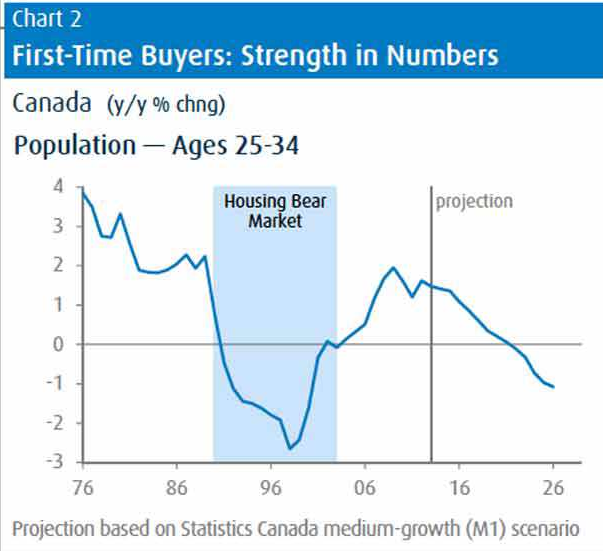

“In 2015 total housing starts are forecast to decline but still reach its second highest level since 2006. Job creation in Calgary is forecast to moderate from the elevated pace in 2014 and net migration, although remaining positive, will decline as economic conditions improve in other areas of the country. We are also anticipating that buyers will have more homes to choose from as average monthly active listings are expected to be higher. The number of new homes under construction has increased and may put more upward pressure on inventories when completed. This will impact the opportunity to increase new construction in 2015.”

For Alberta, starts are forecast to increase by 7.2 per cent this year to 38,600 units but decline by 4.7 per cent next year to 36,800 units.

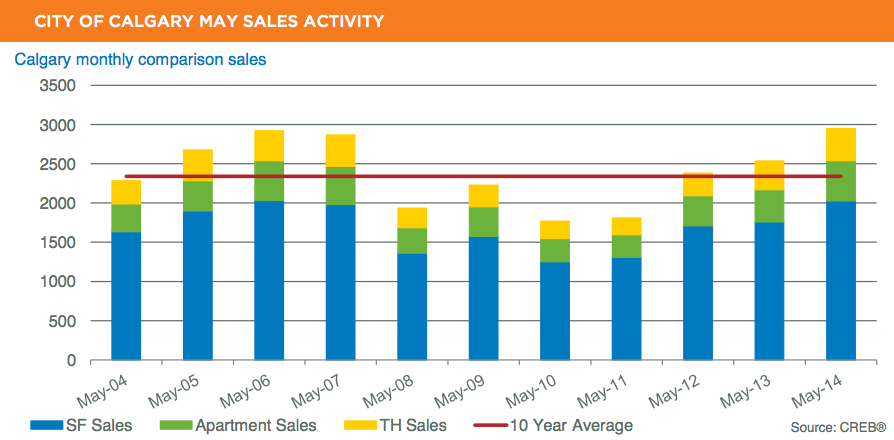

The agency is expecting MLS sales in the Calgary region to improve by 9.8 per cent this year to 32,900 units and by another 2.4 per cent in 2015 to 33,700 transactions. CMHC says the average MLS sale price will rise by 5.0 per cent in 2014 to $459,000 and by 2.8 per cent in 2015 to $472,000.

“The economy in Calgary is anticipated to continue creating jobs, attracting migrants and supporting income growth,” said Cho. “However, the rate of increase in some of these key housing demand factors will moderate throughout the forecast period. This will also be reflected in the resale market.

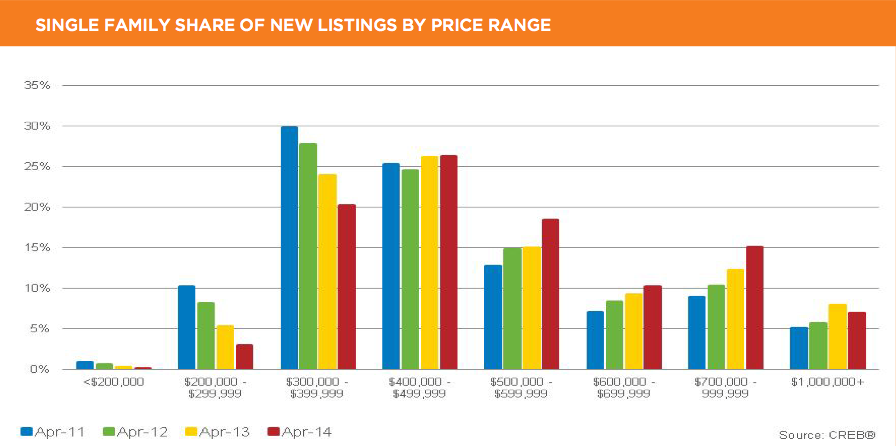

“Home prices in Calgary have experienced more upward pressure from the low supply of active listings on the market compared to previous years. Buyers have been competing for a lower selection of homes, resulting in multiple offers on many homes and shortening the average days-on-market. The MLS price is forecast to rise five per cent in 2014. As we move towards the end of 2014 and into 2015, the supply of resale homes is anticipated to move higher. New listings in Calgary have started to pick up and are forecast to rise this year and next. This will help ease some of the upward pressure on prices in 2015 resulting in a 2.8 per cent increase.”

For Alberta, MLS sales are forecast to be 5.8 per cent higher this year to 69,900 followed by a 2.9 per cent gain next year to 71,900.

The average sale price in the province is expected to increase by 4.2 per cent this year to $396,800 and by 2.6 per cent next year to $407,000.